F1 Student Tax Filing

SprinTax Reviews - File International Student Taxes - F1 OPT

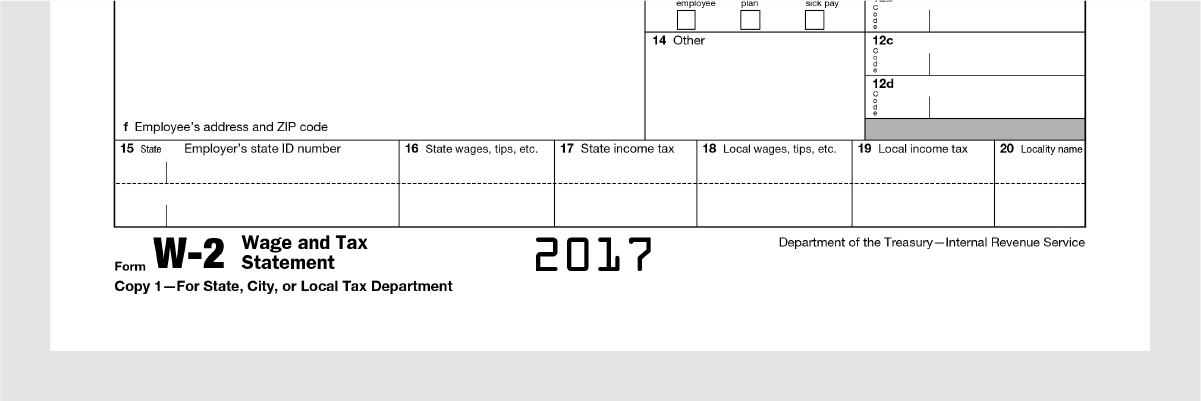

Finally there s a Software as a Service provider - SprinTax can help Non-Resident for Tax Purpose like F-1 Visa J-1 Visa OPT STEM OPT Students and scholars to prepare their taxes online. I came to know about SprinTax back in 2013 when one of their team members reached out to me.The IRS requires federal income tax withholding on all U.S. source payments to nonresident alien students. OPT as well as individual students are taxed on their wages at graduated rates 10 to 39.6 . It is depending on your income level. The tax percentage withheld on scholarships and grants for F-1 and J-1 visa holders is 14 .Students with F-1 visas may apply for 12 months of OPT after each level of education complete. If you earn an income from an OPT you will be required to pay tax. You must also fill in a W-4 tax form with your new employer when you start work. Learn more about your tax obligations under OPT in this guide.

The filing of international student taxes doesn t take long and it s not a complicated process. You can file your taxes using SprinTax. Here s my SprinTax Reviews. Universities and colleges commonly conduct seminars or workshops to inform international students on how to file international student taxes F1 Visa or J1 Visa .65 international tax treaty agreements and exemptions Maximum legal tax refund guaranteed 100 US tax compliancy guaranteed Prepare your US Taxes. from 34.95. Sprintax has helped 100 000 students scholars J1 workers interns trainees professionals au pairs and councillors prepare US tax returns. Help me with my US taxesadditional information is responsible for irs including income from the time accessing this. SprinTax Reviews File International Student Taxes F1 OPT. If you not subject to attract income taxes income earned as an independent contractor your residency status will be determined stage you by answering a transcript of questions.

SprinTax Reviews - File International Student Taxes - F1 OPT. Best Deals From www.happyschools.com Here s SprinTax Reviews from Happy Schools and new users who filed their taxes using Sprintax. International Students here in the U.S. are required to file taxes.Log-in page for Sprintax tax filing software - 1040NR tax forms for international students and scholars. Click here to sign-in.Sprintax Reviews File International Student Taxes F1 Opt Nonresident Alien Tax Issues And The Glacier System A Irs Federal Income Tax For Residential Aliens 2016 Tax Return For F1 Visa Student By 61 Software International Student Guide To Living And Studying In The

Can international students use turbotax to file tax returns No If you are an international student and need to file Form 1040-NR you will not be able to use TurboTax. Unfortunately you have to find another method to prepare your tax returns. View solution in original post.Aliens temporarily present in the United States as students trainees scholars teachers researchers exchange visitors and cultural exchange visitors are subject to special rules with respect to the taxation of their income. There is no minimum dollar amount of income which triggers a filing requirement for a nonresident alien including foreign students or foreign scholars.SprinTax Reviews - File International Student Taxes - F1 OPT. Shop And Save at www.happyschools.com Here s SprinTax Reviews from Happy Schools and new users who filed their taxes using Sprintax. International Students here in the U.S. are required to file taxes.

If you do not have to file an income tax return send Form 8843 to the address indicated in the instructions for Form 8843 by the due date for filing an income tax return. If you do not timely file Form 8843 you cannot exclude the days you were present in the U.S. as an exempt individual or because of a medical condition that arose while you Only if you are considered resident alien for tax purposes. Tax Residents generally follow the same tax rules as U. The beginning of a new and hopeful year. com is built to help p2019 Income Tax Filing deadline is April 15 2020. For information on how to file your 2019 taxes as a Non-Resident please view the Annual Income Tax Return Filing page linked below. Non-Resident tax preparation software GLACIER -for Federal Income Tax Returns and SPRINTAX -for State Income Tax Returns for tax year 2019 went live on Tuesday

Office of International Student and Scholar Services OISSS International Student Scholar Tax Preparation Support 2020 U.S. Income Tax Filing deadline is April 15 2021.Taxes for Students on OPT - The Ultimate Tax Guide. Posted 7 days ago Jul 03 2020 The IRS requires federal income tax withholding on all U.S. source payments to nonresident alien students. OPT as well as individual students are taxed on their wages at graduated rates 10 to 39.6 .The substantial presence test calculator is used to determine if you will be considered as Resident Alien for Tax Purpose. This applies to several visa holders. If you currently in U.S. in H1B Visa then you have to pass substantial presence test calculator to be considered as Resident Alien for Tax Purpose.

Generally an alien in H-1B status hereafter referred to as H-1B alien will be treated as a U.S. resident for federal income tax purposes if he or she meets the Substantial Presence Test. The test is applied on a calendar year-by-calendar year basis January 1 - December 31 .

worklife A Graduate Student s Guide to the Galaxy

F 1 Tax

F 1 Taxes

5 Tips for Maintaining Your F1 Visa Status

F 1 Tax

F 1 Tax

Career Resource Blog OPT CPT F-1 visa H-1B visa

Smart Article Student - CAPITAL TRAINERS

E Tax Services - Dwyer Lodha Associates - Sanjay Ladha