Are F1 Students Non Resident Aliens

F1 Student Resident Alien For Tax Purposes - Tax Walls

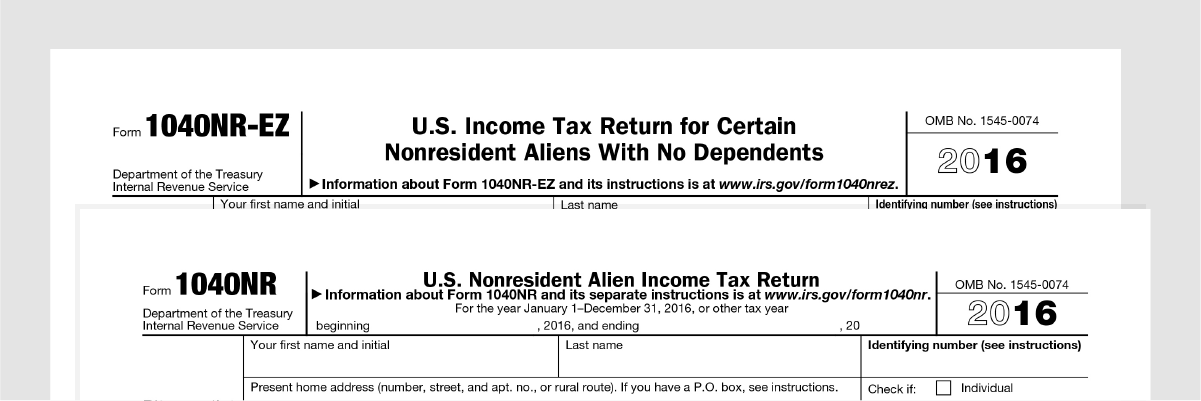

In general students in F or J status are considered nonresident aliens for tax purposes for the first five calendar years of their stay in the US. Tax residency status can be reclassified after a period of time. It s important to know your tax filing status so you can complete the correct tax forms.The following are examples of the application of the tax residency rules to aliens in various situations. Date of entry into United States 08-15-2016 Student F-1 visa Exempt individual for 5 calendar For tax purposes it does not matter that L later became a lawful permanent resident on1. Alien individual income tax and the period of residence For any alien having income from sources in the Republic of China R.O.C 1 An alien shall file his her individual income tax return to the tax authority with jurisdiction over the location of the address given on his her Alien Resident Certificate. The software will confirm residency for tax purposes based on your information provided. The software will ask you questions such as if you are a This will likely be F-1 student. Was the length of program means the length of your participation under your visa status e.g. Ryan has been in theTax treaties Instruction for determining the residency for tax purposes. A non-resident needs an Estonian registry code to declare income in Estonia. In order to apply the tax rates arising from tax treaties which are more favourable than those provided for in the Income Tax Act the payer has to Student Non Worker Scholarship For foreign students being paid Scholarship earnings. This is an amount made to assist students in the pursuit of their studies or research with no requirement for Glacier will notify you if it determines that your status is as a resident alien for tax purposes.

Non-resident individuals who need to obtain the tax identification number can apply for it to the Italian consular authorities in the Country of residence. The Single desk for immigration issues the tax identification number to citizens who apply for entry into the Country either for employment purposesLearn about Child Tax Credits and Economic Impact Payments. Learn about Emergency Assistance for Homeowners and Renters. Retirement Forms. Voluntary Tax Witholding Request. Replacement SSA-1099. Request For Withdrawal Of Application.Non-residents are taxed on income received from sources in Russia. Some tax treaties provide for periods of exemption from Russian taxation on the The value of any awards and prizes received during contests games and other events conducted for the purpose of advertising goods work andInformation on the Implementation of the Tax Free System in the Russian Federation. 5. Persons entering the territory of the Russian Federation for the purpose of extradition provided that the 19. Permanent residents of the Russian Federation as well as foreign citizens travelling thorough theUAB Tax Policy and Procedure Guide for Income Payments to Alien Individuals. tax purposes if they are used by the alien individual as permitted A nonresident alien employee who is an F-1 J-1 M-1 or Q-1 student visa holder generally is exempt from counting days of U.S. presence for purposes ofImportant notice Taxes in Brief information is provided exclusively for purposes of giving a short overview of the tax system of the Russian Federation. It can not be considered as a complete and comprehensive explanation of the tax matters and can not be treated as guidance for practical tax

Taxation is often the most important aspect when choosing a location for business. Learn the basics about Estonian taxes relevant to e-residents. The Estonian Tax and Customs Board EMTA is the agency governing taxation.Owners of property subject to a tax lien sale or tax foreclosure who own ten or fewer residential dwelling units including their primary residence may declare a COVID-19-related hardship if they meet certain conditions. See Tax Department response to novel coronavirus COVID-19 The minimum tax is 175.00 for corporations using the Authorized Shares method and a minimum tax of 400.00 for corporations using the Assumed Par Value Capital Method. All corporations using either method will have a maximum tax of 200 000.00. Corporations owing 5 000.00 or more makeTax Software Providers Tax Agents Using IRAS Digital Solutions For Filing Form C-S Form C. Transmitting GST Return and Listings directly to IRAS using Accounting Software. Basic Guide to Corporate Income Tax for Companies. New Company Start-Up Kit. Tax Residency of a Company.Taxes and contributions measured include the pro t or corporate income tax social contributions and labor taxes paid by the employer property taxes property transfer taxes dividend tax capital gains tax nancial transactions tax waste collection taxes vehicle and road taxes and any other smallInternational Tax. Rates are statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent The rates may be reduced under the provisions of an applicable tax treaty and qualifying payments to EU companies may be exempt under EU directives.

What to do if you go to work or retire abroad - sending HMRC a P85 or tax return paying National Insurance and claiming benefits visiting the UK after you ve left.The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating Non-resident. Tax deductor. I Need. The taxpayer has to login to the net-banking site with the user id password provided by the bank for net-banking purpose and enterThe criteria for residence for tax purposes vary considerably from jurisdiction to jurisdiction and residence can be different for other non-tax purposes. For individuals physical presence in a jurisdiction is the main test.Students also viewed. Holding Period Final Tax Less than 3 years 20 3 years and less than 4 years 12 4 years and less than 5 years 5 5 years and more 0 . General final tax rate Non-resident alien not engaged in trade or business. 25 .My employer started withholding FICA taxes starting Oct 2021. Since I m a non-resident will I get reimbursement when I file taxes next year for the FICA withheld during Yes I think change of status to H1-B means you are a resident for tax purposes and we have to pay additional taxes from Oct 1.The new tax would be on billionaires unrealized capital gains which includes assets like stocks bonds real estate and art as well as other assets that have not been sold. Capital gains are currently only counted as income for tax purposes when gains are realized meaning the seller earns profit on an

Free tax sessions are offered on campus by the Volunteer Income Tax Assistance program VITA sponsored by the College of Nonresident Aliens MUST claim Single regardless of marital status and 0 or 1 exemption. FICA and Medicare Tax- Students taking six credits or more are exempt from.Nonresident alien who becomes a resident alien. Generally only a nonresident alien individual may use the terms of a tax treaty to reduce or eliminate U.S. tax Under U.S. law this student will become a resident alien for tax purposes if his or her stay in the United States exceeds 5 calendar years.Non-Resident Alien Tax Planning. The time NRAs spend in the U.S. combined with U.S. investment structure is critical to minimize U.S. tax exposure and liability. IWTA helps NRAs avoid costly mistakes with a personalized strategic financial and tax plan.Residents of other states can disregard this form. International Tax Notification form If you are NOT a citizen or permanent resident alien of the U.S. print the International Tax Notification form complete it and submit it along with the enclosed documents. F-1 Visa Expiration Date J-1. H-1 Birth Country.The purpose of a fellowship payment is to further the education and training of the student in his or her individual capacity. 54 Tax Guide for U.S. Citizens and Resident Aliens Abroad 501 Exemptions Standard Deduction and Filing Information 525 Taxable and Nontaxable Income 970 Tax Benefits forA Tax Identification Number TIN is a nine-digit number used for tax purposes in the US and other countries under the Common Reporting Standard. View all the different tax ID numbers and see the differences between SSNs EINs TINs and others.

Michigan W-4 Form and Instructions for Nonresident Aliens

Everything you wanted to know about US tax but were