Tax Deductions For F1 Students

F 1 Tax

F-1 Visa does not let you pay for Social Security tax Medicare tax while on F1 status Which means whether you are doing CPT OPT or on OPT Extension you do not have to pay those taxes unlessThough taxes are probably the last thing on your mind when you re heading off to college it s wise to get familiar with some US tax basics as an international student or scholar. The most important thingForeign tax laws are definitely one of them As an F1 student with a temporary job you might Below we take a look at what types of income are subject to F1 visa taxes and what your tax responsibilitiesArticle 20 of the US-China Tax Treaty provides that a resident of China who goes to the USA for the per year of income for personal services performed in that other State. This means that F-1 Students

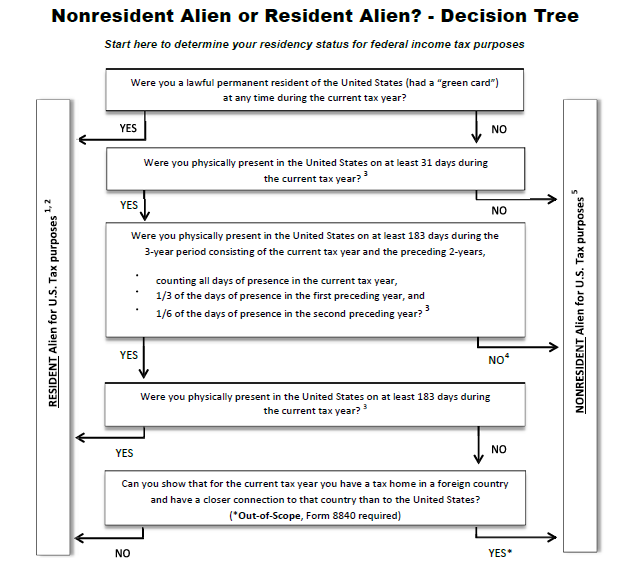

Learn more about F-1 tax requirement from Pepperdine University Admissions. The following is a general overview of federal-tax obligations for F-1 students. The staff of the Office of InternationalIn general aliens performing services in the United States as employees are liable for U.S. Social Security and Medicare taxes.Filing taxes may not be something very exciting but it s something you shouldn t procrastinate about. As an international student on an F-1 visa in the USA you will be taxed on the income earned in theFor US tax purposes you do not count your time in the US on an F-1 visa as days of presence in the US which generally means that you Can students on F1 visas file their taxes electronically

The Federal Insurance Contributions Act FICA fa k is a United States federal payroll or employment contribution directed towards both employees and employers to fund Social Security and Medicare federal programs that provide benefits for retirees people with disabilitiesAnnex F-1 tax changes. S N Name of Tax Change. Extending Budget 2020 Temporary Tax Measures to Support Businesses. 1. Extend the Year of The carry-back relief scheme was enhancedF-1 Social Security FICA Tax J-1 - University Of Pennsylvania Social Security FICA Tax Prevention and Recovery F-1 J-1 International Student and Scholar Services Overview If you are a foreignMy H1B was approved in June 2019 I have been on F1 all the time before this date and was Exempt . Should I be filing taxes for 2019 as a Resident Alien or a Non-resident alien 1040 or 1040NR

3y1s Tax f 1 Fullshem - Free download as Word Doc .doc .docx PDF File .pdf Text File .txt or read online Original Title. 3y1s Tax f 1 Fullshem. Copyright. Attribution Non-Commercial BY-NC .Tax brackets and rates for the 2021 tax year as well as for 2019 and previous years are elsewhere on this page. 2020 federal income tax brackets. for taxes due in May 2021 or in October 2021 with ane. Example for Old Tax regime Vs New Tax regime which is better 86 2020 32 ---I785VAA1 AMT Tax Tuning CVN 078D2B8E E2 Phase.bin

Every international student is required to file a tax return as a condition of your visa but not everyone will pay taxes to the American government. International students are entitled to a number of benefitsNeed tax advice Schedule a free tax office hour session with a tax professional. Sign up . Firstbase Live All about taxes Thursdays at 10 am EST. Register now .State income tax is separate from federal income tax. Sprintax can also generate state tax returns for most of the states in addition to New York State. Learn about state taxes at one of the workshops.TAX PREP SOFTWARE FOR NON-RESIDENT ALIENS Glacier Tax Preparation Software . Form 8843 Must be completed by each scholar at UMass Amherst who is in J-1 or F-1 status and who is a

This site is best viewed in 1024 768 resolution with latest version of Chrome Firefox Safari and Internet Explorer. Copyright Income Tax Department Ministry of Finance Government of India.We also identify Tax as a positive regulator of the expression of the gene for XBP-1. Activation of the UPR by tunicamycin showed no effect on the HTLV-1 LTR suggesting that HTLV-1 transcription isFirst tax payment when you register the vehicle. You ll pay a rate based on a vehicle s CO2 emissions the first time it s registered.

F 1 Student Visa Tax Exemptions

Georgia driver license Psd Template V1 Psd templates

WATCH Students shut down Unisa campus over NSFAS

Fake Bank Account Statement Creator SAUPIMMEL in 2020

Bank Statement Bank America Statement template Credit